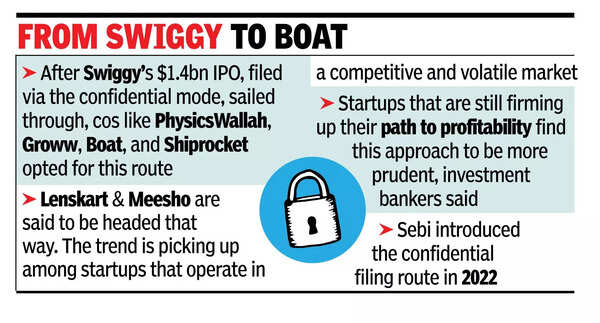

MUMBAI: Startups preparing to go public are increasingly opting for the confidential IPO filing route.After Swiggy’s $1.4-billion IPO last year, filed through the confidential mode, sailed through, a clutch of firms including PhysicsWallah, Groww, Boat, and Shiprocket have taken this route. Lenskart and Meesho are also headed this way, sources said. While traditional companies such as Vishal Mega Mart have opted for this mode, and recently, Tata Capital chose to go confidential, the trend is picking up among startups that operate in a competitive market.For one, a confidential filing allows startups to keep their business metrics and performance away from the public eye. It also gives them the leeway to test the market appetite and accordingly decide on the IPO timing. Startups that are still firming up their path to profitability find this approach to be more prudent, investment bankers said.

“The trend has been picked up by startups which are in very competitive businesses as it helps them to shield public disclosure of their KPIs and other sensitive business information like clients and vendors. This could also be useful in cases where issuers have a slightly longer time frame in mind for IPOs, yet want to get the regulatory clearance as Sebi observations are valid for an 18-month period in this route,” Anurag Byas, director, equity markets solutions at Rothschild & Co, told TOI. The first batch of big startup IPOs was seen in 2021 when, fuelled by the pandemic-led surge in appetite for digital services, companies rushed to the markets to capitalise on consumer sentiment. Sebi introduced the confidential filing route in 2022. “Companies facing intense market competition prefer shorter windows for narrative battles in the public square. Less time spent on information wars is better for companies focused on frenetic growth and execution,” said an executive at an IPO-bound startup which took the confidential route on condition of anonymity.Zepto, PhonePe, Pine Labs, and Lenskart are among a spate of startups that are eyeing a public listing. In a volatile market, the option of confidential filing becomes more favoured. “With global rate cycles and geopolitical risks keeping equity markets volatile, startups prefer to keep their listing ambitions discreet. This route allows them to stay prepared, monitor the sentiment, and hit the market quickly when windows open up,” said Prakash Bulusu, joint CEO at IIFL Capital.The practice of confidential filing is in place in developed jurisdictions, and the adoption in India gives issuers greater flexibility, said Kailash Soni, head of India equity capital markets at Goldman Sachs.“Companies are choosing to realign their strategies and focus on investor marketing after receiving Sebi’s approval,” said Gaurav Sood, MD & head, equity capital markets at Avendus Capital. This has helped issuers to consult with Sebi for views on regulatory issues and test waters from a valuation perspective, added Arka Mookerjee, partner at JSA.