Shares in Robinhood Markets Inc. were up over 3% in late trading today after the financial services company surprised with an earnings beat in its fiscal 2024 second quarter off the back of surging levels of customer trading, particularly in cryptocurrency.

For the quarter that ended on June 30, Robinhood reported adjusted earnings per share of 21 cents, up from three cents per share in the same quarter of 2023, on revenue of $682 million, up a healthy 40% year-over-year. Analysts had expected earnings per share of 15 cents and revenue of $682 million.

The story of Robinhood’s quarter came down to more people using its trading platform, with transaction-based revenues increasing 69% year-over-year to $327 million, with options revenue up 43% to $182 million, cryptocurrencies revenue up 161% to $81 million and equities revenue up 60% to $40 million. Net interest revenue was up 22% year-over-year to $285 million and other revenue, which includes gold subscription services, was up 19% to $70 million.

As of the end of the quarter, the company had 24.2 million funded customers, up one million year-over-year and investment accounts were up 1.4 million to 24.8 million. Assets under custody were up 57% year-over-year to $139.7 billion, representing both an increase in net deposits and higher equity and cryptocurrency valuations.

While revenue and usage were up by double figures percent across the board, Robinhood successfully managed to mostly contain any increasing costs concurrent with surging use, with total operating expenses up a fairly modest 6% year-over-year to $493 million.

Notable business highlights in the quarter include Robinhood announcing on June 6 that it had agreed to acquire cryptocurrency exchange Bitstamp Ltd. in a $200 million cash deal. Bitstamp holds more than 50 active licenses across the world, with the deal, once completed, giving Robinhood the ability to expand its cryptocurrency trading service into more countries.

“I’m encouraged by the progress we’re making as a business,” Jason Warnick, chief financial officer of Robinhood, said in the company’s earnings release. “In Q2, we set new quarterly records for revenues and earnings per share as we continue to focus on delivering another year of profitable growth.”

Providing a standard forecast when a sizeable portion of your business involves cryptocurrency is a hard ask and Robinhood doesn’t, although the company did say that a previous forecast for operating expenses and stock-based compensation for the full-year 2024 remains unchanged at $1.85 billion to $1.95 billion.

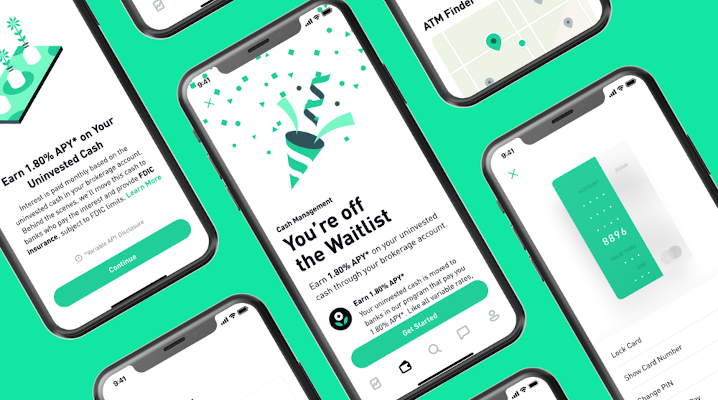

Image: Robinhood

Your vote of support is important to us and it helps us keep the content FREE.

One click below supports our mission to provide free, deep, and relevant content.

Join our community on YouTube

Join the community that includes more than 15,000 #CubeAlumni experts, including Amazon.com CEO Andy Jassy, Dell Technologies founder and CEO Michael Dell, Intel CEO Pat Gelsinger, and many more luminaries and experts.

THANK YOU