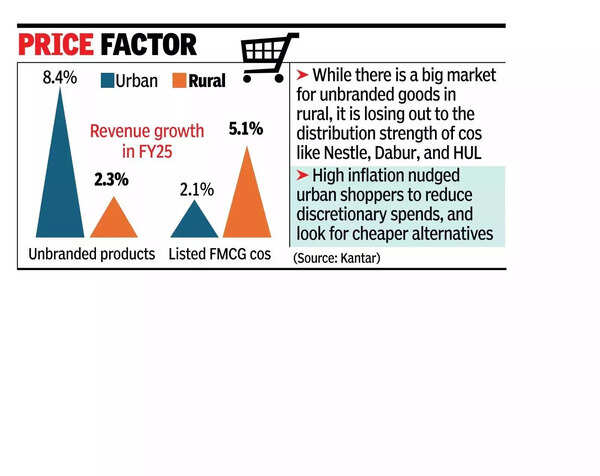

MUMBAI: The grocery bag of urban and rural shoppers is undergoing a divide. Urban Indians are gravitating towards unbranded products in select categories and are also experimenting with new-age brands, while rural consumers are taking to legacy FMCG brands. While there is a big market for unbranded goods in rural, it is losing out to the distribution strength of companies like Nestle, Dabur, and HUL, which are rapidly expanding their rural coverage. For digital-first brands, it will take years, if not decades, to reach this scale.Volume Growth GapCall it the impact of high inflation seen in the past few quarters or a growing knack for experimentation within urban consumers partly fuelled by online boom, unbranded products are growing faster in cities. A report released by Kantar last month showed that unbranded products recorded an 8.4% volume growth in urban India in FY25 compared to rural’s 2.3% growth rate. On the contrary, the volume growth recorded by the 22 listed FMCG companies (only those which contribute to volume growth of the industry meaningfully have been captured) stood at 2.1% in urban regions; in rural areas, the number touched 5.1%.“Currently, about 26% of the FMCG volumes come from the unbranded segment in urban India… they are strong in categories like atta, rice, spices, edible oils, and floor cleaners. Price plays a big role in picking up unbranded products in segments like floor cleaners, and inflation likely nudged more metro shoppers to shift to unbranded goods. However, unbranded doesn’t always mean it is cheap. In categories such as coffee, while unbranded is relatively a smaller portion, people go for unbranded for its taste and aroma,” Manoj Menon, director, commercial at Kantar Worldpanel, South Asia, told TOI.Rural India has been growing faster than its urban counterpart for five consecutive quarters, data released by NielsenIQ for the March quarter showed, as high inflation nudged urban shoppers to cut back on discretionary spending, move to smaller packs, and at times look for cheaper alternatives. A good monsoon last year and govt policies supported rural incomes. There have been some initial signs of recovery, though, with urban volume growth picking up in the June quarter, companies said.

Online Vs MainstreamFor traditional FMCG players, the challenge is on two fronts – getting people to move from unbranded to branded consumption and keeping up pace with an influx of new-age or digital-first brands, many of which are tapping into spaces and trends big players failed to capture. Take Slurrp Farm, for instance, which started building millet-based products much before they became part of mainstream conversations. The brand, which sells both online and offline, gets more reach and revenues from digital, with quick commerce now contributing 35-40% of total sales, said co-founders Meghana Narayan and Shauravi Malik.The rise of online shopping in urban India has given a space to new-age brands in the game. “More prominently in urban India, consumers are trading up across categories. They are growing out of FMCG brands of the past. Product discovery is happening online, and many of the new-age brands are not yet available in general trade,” said Mayank Rastogi, markets leader, strategy and transactions practice at EY India. Big companies have built brands to solve for customers across strata; their businesses are not configured to solve for quick innovation. “D2C new-age brands with their succeed or fail-fast DNA are quick to change product formulations, packaging,” said Rastogi. The availability of brands (on digital) and the proliferation of advertising into mobile phones are shifting perceptions on branding among urban shoppers who are becoming more “brand agnostic,” Kantar said.Distribution PowerCompanies are building different strategies to win in urban and rural India. Britannia is making digital-first launches in big urban metros to cater to premium and convenience-seeking consumers. In rural areas, the firm is expanding distribution, said Vipin Kataria, chief commercial officer, sales & replenishment at the company. A lot of ITC’s new products in urban areas today are quick commerce first, said Sandeep Sule, divisional chief executive, trade marketing & distribution, FMCG at ITC. For rural areas, the strategy is to innovate across product formats and price points.Dabur is expanding its rural basket by way of affordable and rural-specific packs. “The rural consumers across all income segments are exhibiting a marked propensity towards spending on premium, high-quality products which are backed by strong brand values, even at a high price,” said CEO Mohit Malhotra. “While quick commerce is an emerging channel (in urban areas), it currently addresses more impulse and top-up needs,” said Angshu Mallick, MD & CEO at AWL Agri Business.