MUMBAI: Dutch technology investor Prosus will use a mix of investments and acquisitions to bolster its play in India, where it is seeking to build a portfolio worth $50 billion in the years to come, Group CEO Fabricio Bloisi, who took over the top job in July last year, said.The firm’s approach will not be like that of a venture capital (VC) investor looking to close a series of deals at a faster clip. The strategy will rather be to build an ecosystem by investing in or acquiring companies within its core sectors, which can potentially open up opportunities for cross-selling among its portfolio firms and unlock faster growth for the broader portfolio.India, where Prosus will be allocating most of its resources alongside Europe and Latin America, is a market with a lot of potential, Bloisi said, adding that the company will be investing billions in India in the next few years. “We want to be less of an investor that has a pipeline of 100 companies with 5% (stake) in each one and more of an ecosystem that develops synergies between our own companies… We intend to invest more money in more companies.I will be disappointed if it’s not a few billion,” Bloisi told TOI in an interview.

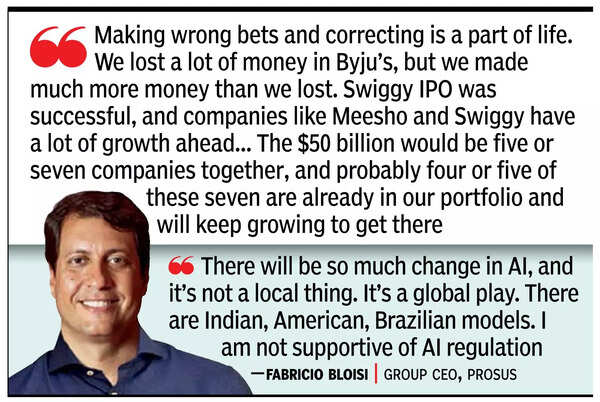

Prosus has invested $8.6 billion in India so far and has backed a clutch of startups, including Meesho, Swiggy, Urban Company, and Rapido. It also had a few failed bets like Byju’s, which Bloisi said was the “worst problem” the company faced globally. However, the downfall of India’s biggest edtech startup, once valued at $22 billion, did not change its investment perspective on the country. “Making wrong bets and correcting is a part of life.We lost a lot of money in Byju’s, but we made much more money than we lost. Swiggy IPO was successful, and companies like Meesho and Swiggy have a lot of growth ahead… The $50 billion would be five or seven companies together, and probably four or five of these seven are already in our portfolio and will keep growing to get there,” Bloisi said.Prosus will continue to prioritise investments in its core areas of food delivery, payments, e-commerce, experience (including services provided by firms like Urban Company), and AI. Bloisi, however, said that options in other sectors will not be closed, and it will be open to scouting for opportunities in emerging sectors such as clean tech and EV, although the company is unlikely to go big on these sectors as of now.Within AI, where Bloisi said India can do more, the company’s strategy will be to back companies that are using AI to build their services, offer more use cases to consumers, and incorporate AI tools to make systems more efficient rather than betting on firms developing pure-play AI models. Meesho, for instance, he said, was able to reduce its costs by using AI, besides adding more languages to its app, enabling it to reach more consumers.“Most of the successful companies of the future are being built today on top of the (AI infrastructure) models. They (models) are just the first step… there’s so much value to build, for example, marketing or video companies that are going to use AI models to offer services, and these are the type of companies we expect to invest in,” Bloisi said, voicing the need for calibrated regulation.Regulating a sector like AI, which is still nascent and evolving, will slow innovation. “There will be so much change in AI, and it’s not a local thing. It’s a global play. There are Indian, American, Brazilian models. I am not supportive of AI regulation,” Bloisi said.Prosus expects five companies from its India portfolio to go public this year, but Bloisi declined to name them. Urban Company and BlueStone have already filed draft IPO papers with Sebi, while some, like Meesho, are preparing to list.