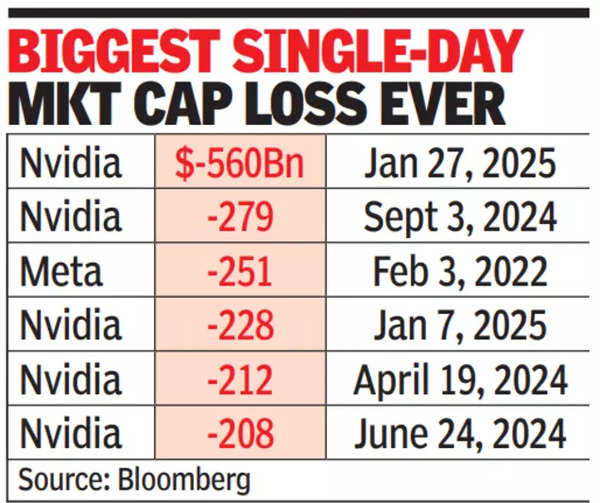

MUMBAI: Global markets went into a fresh turmoil on Monday after a Chinese AI startup DeepSeek released its low-cost AI model that prompted tech analysts to question if the current high valuations for giants like Nvidia, Google and Microsoft were justified. As a result, in early trades on Wall Street on Monday, Nvidia lost as much as 18% that also wiped off about $560 billion from the AI chip giant’s market value – largest in market history. For perspective, that’s nearly equal to the combined market value of the top three companies in India: Reliance Industries, TCS and HDFC Bank.

Initial test results for DeepSeek R1 model showed better efficiency compared to the latest version of ChatGPT, currently the global leader in AI applications. Analysts now feel that the low development and running costs of the Chinese AI model with better results than ChatGPT could lead to a massive slide in stock prices of high cost AI-chip manufacturers like Nvidia, TSMC and others.

Earlier in the day, trading on Dalal Street was also impacted by the global turmoil on the back of DeepSeek’s superior performance and its implications for global tech giants. Combined with relentless foreign fund selling, the sensex closed 824 points down at 75,366 points, a more than seven-month closing low. Technology stocks led the slide.

With US markets deep in the red in early trades and the US Federal Reserve’s rate setting committee meeting scheduled later this week, domestic investors are still edgy, market players said. However, they could take some solace from GIFT Nifty index, a proxy for start of trading in the domestic market for the next session, which was in the positive territory late on Monday.

On Dalal Street on Monday, the sensex opened in the red and lost steam through the session to close near the day’s low. In addition to the global cues, tepid corporate earnings and uncertainty around US trade policy also impacted investor sentiment, said Siddhartha Khemka of Motilal Oswal Financial Services.