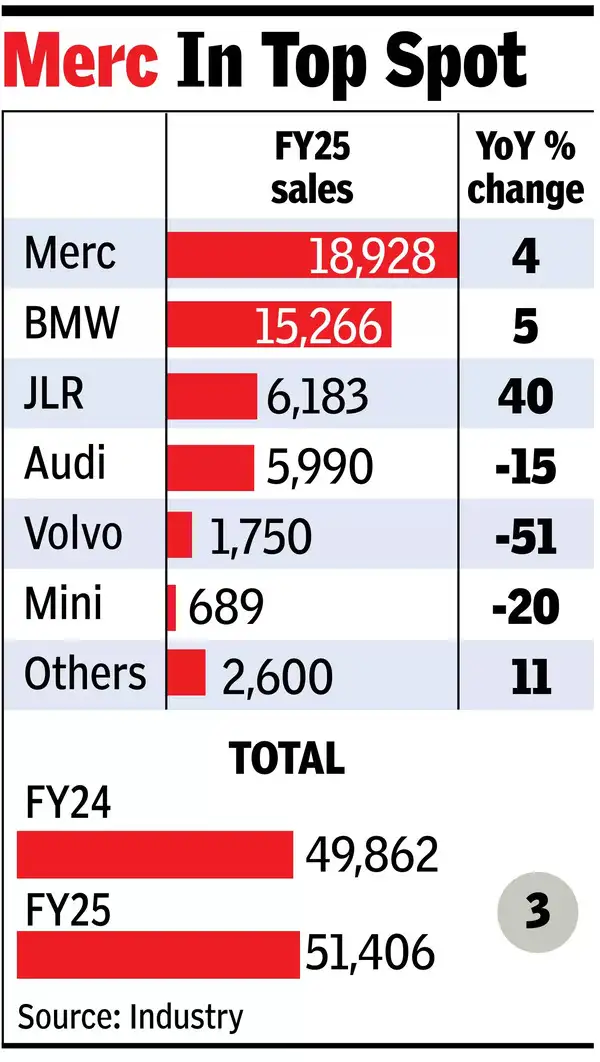

NEW DELHI: Tatas-owned Jaguar Land Rover (JLR) entered the Top 3 luxury car ranking by surging ahead of German Audi, with the category crossing the psychological 50,000-unit mark in FY25 for the first time by registering 3% growth in the financial year.

While sales have started to slow down from Jan-March ’25 quarter as the stock markets took a beating and some concerns started to build up around the economy, the industry still managed to post growth for full fiscal, registering sales of 51,406 units.

JLR has shown healthy performance, despite near absence of Jaguar models with availability of only a few units of F-Pace. SUVs of Land Rover led the growth. JLR sold 6,183 units in FY25 at a growth of 40% (4,417 units in FY24), ahead of Audi’s 5,990 units, where numbers declined by 15% (7,027 in the previous year).

“In FY25, Defender was the highest selling-model with a growth of 90%, followed by the locally-manufactured Range Rover and Range Rover Sport at 72% and 42% respectively,” Rajan Amba, MD of JLR India, said. The company is hopeful of continuing the growth momentum in FY26. Sources in VW group, owner of Audi, said the brand was impacted by “supply constraints and red sea crisis” last year. “In spite of limited product offerings, the company has started 2025 with growth in quarter one. However, long-term outlook remains challenging until new products arrive.”

JLR was behind Mercedes-Benz and BMW, who occupied top two positions in the luxury car market respectively. Mercedes sold 18,928 units at a growth of 4%, while BMW saw numbers move up 5% on sales of 15,266 units.

Mercedes MD & CEO Santosh Iyer said the company’s volumes were led by new product launches, as well as upgradation of network. “Strong performance of core and top-end luxury segment remained the highlight of last fiscal,” he said.

Vikram Pawah, president and CEO of BMW India, said the brand continues to see healthy demand, and has seen strong performance of its electric vehicles range. “We see healthy adoption of electrics in our portfolio and are confident to grow this share further.”