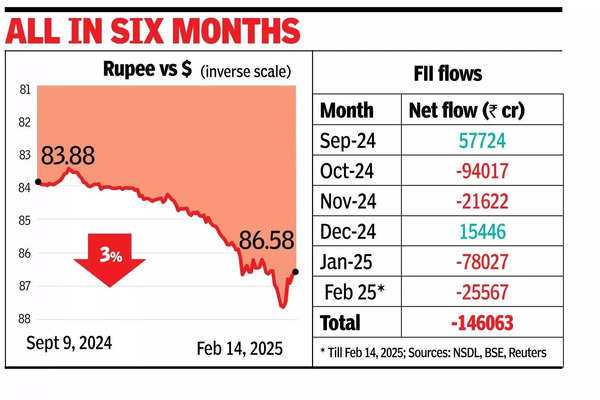

MUMBAI: Net outflow by foreign funds on Friday crossed the psychologically important Rs 1 lakh crore mark for 2025, weighing on domestic investor sentiment in the stock market and also pulling the rupee back against the dollar even as the greenback in recent days showed signs of easing against other major currencies.

On Friday, foreign funds net sold stocks worth Rs 4,295 crore, BSE data showed. Combined with data released by NSDL, the total net outflow for the current month was almost Rs 25,570 crore. With a net outflow of Rs 78,027 crore in Jan, the aggregate net selling in the last one-and-a-half months in the year was nearly Rs 1.04 lakh crore.

Combined with the strength of the dollar, higher crude oil prices and a rising bond yield in the US, the rupee has depreciated 2.6% or Rs 2.22 against the dollar since Nov 20, a day before the US presidential poll results were out. In between last week the rupee had also hit a new life-low mark at 88 but since then has recovered some ground.

On Friday, the rupee strengthened 12 paise after the US delayed the implementation date for its policy of reciprocal tariff to April 1.

“The US dollar declined as President Donald Trump delayed the implementation of reciprocal tariffs to April 1 which calmed market nerves,” Anuj Choudhary, Research Analyst, Mirae Asset Sharekhan was quoted by PTI. Persistent outflows by FIIs may pressurise the rupee further.

However, any further intervention by the RBI may support the rupee at lower levels. Traders may take cues from retail sales and industrial production data from the US, Choudhary said. In the equity market, selling by foreign funds continued to weigh on investor sentiment which pulled the sensex down by 200 points – its eighth consecutive session of losses – to close at 75,939 points. In mid-session, the sensex had hit a low at 75,440 points.

For a brief while during Friday’s session, BSE’s market capitalisation had fallen below the Rs 400-lakh-crore mark. At the peak of the bull run, on Sept 27 last year, BSE’s market cap had peaked at Rs 477.9 lakh crore. On the same day, the sensex had also recorded a new life-high figure at almost 86,000-point mark.

“The risk-averse sentiment continues to rule investors’ minds as corporate earnings are significantly lower than the market expectations during the start of the year, especially for mid- and small caps,” said Vinod Nair, Head of Research, Geojit Financial Services.

“Muted earnings trend, (rupee) depreciation along with external factors like tariffs are expected to keep the sentiments weak in the near term, which could further push FII outflows. Volatility is expected to stay elevated until there is clarity on tariffs and a recovery in corporate earnings.”