NEW DELHI: It is not just Indian households which look to bring gold into their lockers. On Dhanteras, the Reserve Bank of India disclosed that it has shipped another 102 tonnes of gold from Bank of England’s vaults in London to secure locations within the country.

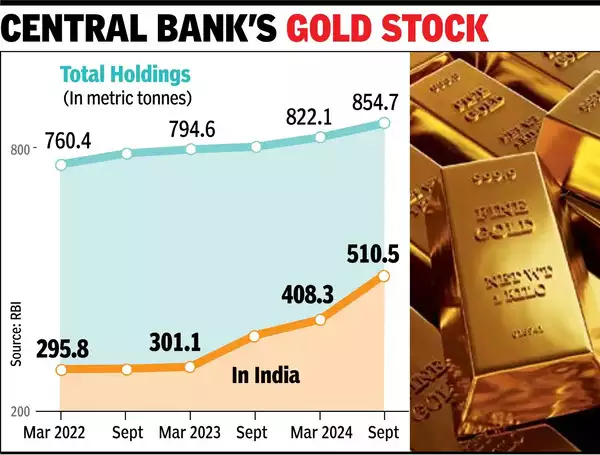

At the end of September, of the 855 tonnes of yellow metal held by the Indian central bank, 510.5 tonnes was held domestically, the latest report on management of foreign exchange reserves revealed. Since Sept 2022, 214 tonnes have moved into the country as RBI and govt sought to secure their holdings amid heightened geopolitical tensions across the globe. Many in govt believe that it’s safer to hold gold at home.

On May 31, TOI was the first to report about 100 million tonnes being moved from the UK and had also said that a similar quantity was planned to be shipped again. The movement marked the first significant shift since gold moved out in early 1990s after govt was forced to pledge it amid a balance of payments crisis.

Like the last time, RBI and govt undertook a secret mission involving special aircraft and detailed security arrangements to move the gold, acutely aware that the information should not leak out. The shipments also require an exemption from the levy of taxes. Authorities are not ruling out further movement although significant shipments are unlikely this year.

Now, 324 tonnes are held in the safe custody of the Bank of England and the Bank for International Settlements, which also keeps the bulk of the precious metal in the UK. A little over 20 tonnes of RBI’s holdings was kept in gold deposits.

The Bank of England provides safe custody for the gold reserves of the UK and other central banks and is the second largest gold custodian after the New York Federal Reserve. The “bullion warehouse” — built in 1697 and subsequently expanded to deal with the gold rush from Brazil to Australia and from California to South Africa — holds around 4 lakh bars of gold. At the start of Sept, these vaults held nearly 5,350 tonnes (or around 17 crore fine troy ounces) of yellow metal.

Quick liquidity given access to the London bullion market was cited as a key advantage of storing gold with the Bank of England. RBI data also revealed that RBI has increased its gold holdings, which at the end of Sept accounted for 9.3% of India’s foreign exchange reserves, compared with 8.1% in end-March.