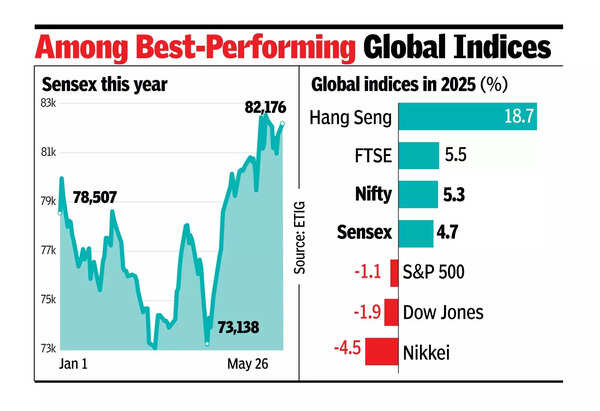

MUMBAI: The sensex closed higher for the second straight session on Monday, driven by gains in auto and IT shares amid easing global trade tensions and supportive domestic factors, including a bumper dividend from RBI and early monsoons. The sensex rose 455 points (0.6%) to close at 82,176, its highest level in over a week. Nifty added 148 points (0.6%) to end at 25,001, a level last seen on May 16.The market opened on a strong note and surged over 770 points during intra-day trade before paring some gains. Buying was broad-based across sectors, with auto, IT, FMCG, and metal stocks leading the advance.“The US decision to consider extending the deadline for imposing aggressive tariffs on the EU, coupled with a decline in the dollar index, contributed to a rebound in the domestic equity markets,” said Vinod Nair of Geojit Financial. “Additionally, the early onset of the monsoon and a decline in domestic bond yields have encouraged investors to maintain their focus on riskier assets.”

Investor sentiment was further buoyed by RBI’s record Rs 2.7 lakh crore dividend payout to govt, which analysts said would support fiscal consolidation. According to V K Vijayakumar of Geojit Financial, RBI’s dividend will help contain the fiscal deficit target for FY26 at 4.4%, which will support lower interest rates.FIIs were net purchasers, buying Rs 135 crore worth of stocks, while domestic institutions made purchases worth Rs 1,745 crore. Among sensex stocks, Mahindra rose the most, up 2.2%, followed by HCL Tech, Tata Motors, Nestle, ITC, HUL, L&T, and Tech Mahindra. On Nifty, Divi’s Labs jumped 3.5% on signing a global pharma supply deal, while JK Cement surged 6% after reporting strong volume growth. Eternal (earlier known as Zomato) fell 4.5%, the worst performer on the sensex after FTSE and MSCI reduced the stock’s weightage.