NEW DELHI: Enhertu, an oncology drug marketed by UK giant AstraZeneca, topped the list of highest-selling new drugs in 2024, generating sales of nearly Rs 58 crore within its first year of launch. A cancer drug topping the sales charts also highlights the growing incidence of the disease in the country.

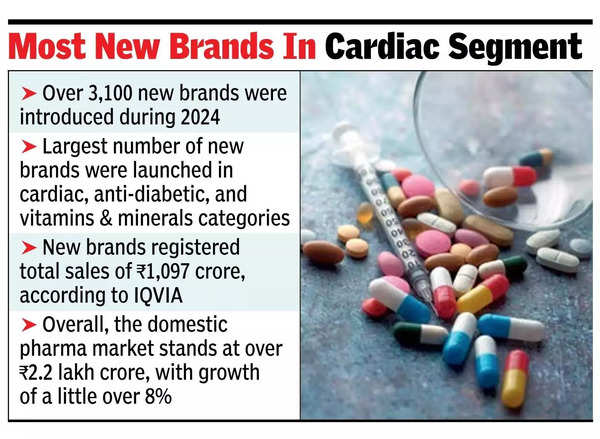

In total, over 3,100 new brands were introduced during the year, collectively registering sales of Rs 1,097 crore, the latest data culled from IQVIA showed.

The largest number of new brands were launched in the cardiac, anti-diabetic, and vitamins & minerals categories, reflecting the prevailing disease patterns across the country.

AstraZeneca’s Enhertu (trastuzumab deruxtecan) was followed by Sun Pharma which achieved sales of Rs 50 crore with 18 brands, and Dr Reddy’s Rs 45 crore with 51 brands, the data showed.

Among the brands launched in the last 12 months, gastro reported the highest value of Rs 167 crore from 394 brands, followed by anti-neoplast/immunomodulator (used in cancer therapy) with Rs 150 crore from 94 brands, and vitamins and minerals with a sale of Rs 126 crore from 505 brands.

For context, the top-selling brand in the entire pharmaceutical market, either antibiotic Augmentin or anti-diabetic therapy Mixtard, generates around Rs 75-80 crore in monthly sales.

Overall, the domestic pharma market stands at over Rs 2.2 lakh crore, with growth of a little over 8%.

In Jan, the growth was led by price increases contributing over 5%, and new product introduction 2.6%, while volume growth was 0.9%.

GSK’s Augmentin continued to be number 1 brand with revenues of Rs 830 crore, growing by 9.3% for the 12-month period.

Certain therapies outperformed the pharma retail market, including cardiac at 10.2%, gastro-intestinal at 10.9%, vitamins at 9.2%, neuro at 10% and derma at 10.1%.

As against this, anti-infectives, anti-diabetic, respiratory, pain and gynaecology segments reported sluggish growth.

The market is growing at a steady rate between 8-10% with certain players, including Sun Pharma and Torrent, exhibiting healthy double-digit growth, IQVIA data showed.