MUMBAI: After a mid-week gap, trading on Dalal Street resumed on Friday and the sensex rose over a 1,000 points, mainly on the back of a record Wall Street rally on Wednesday which came after US president Donald Trump announced a pause on introduction of reciprocal tariffs on all countries except China.

In the process domestic investors on Friday also ignored Thursday’s sell-off in the US markets.

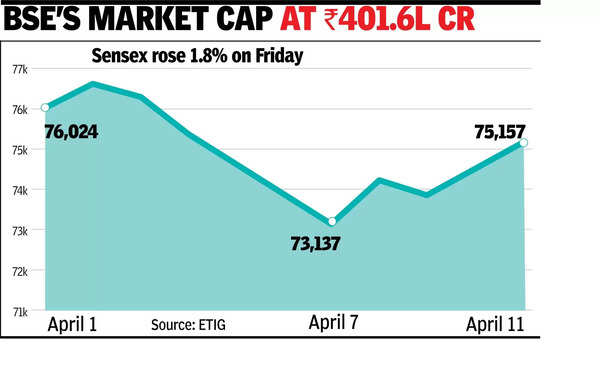

At close of session, sensex was up 1,310 points or 1.8% at 75,157 points while Nifty closed 429 points or 1.9% up at 22,829 points.

The day’s feel-good rally made investors richer by about Rs 7.7 lakh crore with BSE’s market capitalisation now at Rs 401.6 lakh crore.

According to Ajit Mishra, SVP – Research, Religare Broking, the US decision to defer tariffs for all countries except China eased recession concerns, boosting investor sentiment and lifting fears of a global slowdown. “The (day’s) recovery, supported by a continued decline in the volatility index, is a positive sign, though such sharp moves remain challenging to trade,” Mishra said.

The day’s gains came on the back of strong buying by domestic institutions while foreign funds were net sellers. On Friday, domestic funds net infused Rs 3,759 crore into stocks while foreign portfolio investors were net sellers at Rs 2,519 crore, BSE data showed. So far in the month, FPIs have net taken out about Rs 27,000 crore from the Indian stock market, data from NSDL and BSE showed.

During the day’s session of the 30 index constituents, only two-TCS and Asian Paints-closed in the red. The slide in TCS came on the back of its Jan-March quarterly results that failed to enthuse investors.

Going forward, there are several factors that market players should be careful about. “Participants should stay focused on global developments and corporate earnings for further direction,” Mishra said. In addition, any development relating to the ongoing trade-related issues, either positive or negative, would also impact the market’s trend, market players said.