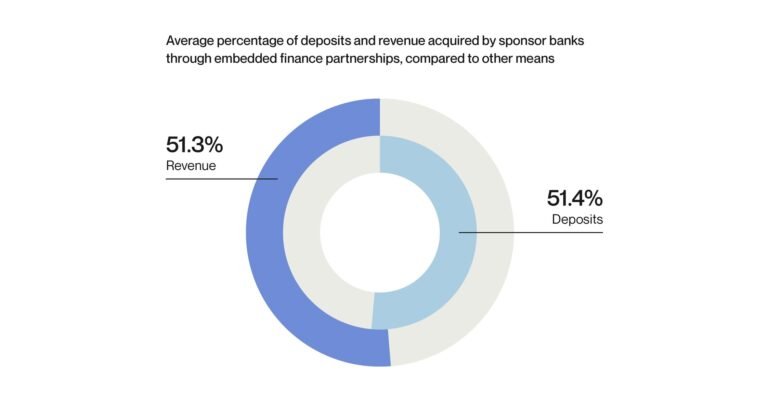

NEW YORK, Aug. 21, 2024 /PRNewswire/ — Alloy, the identity risk management company trusted by over 600 leading banks, credit unions and fintech companies, today released its 2024 State of Embedded Finance Report, a survey of over 50 decision-makers working at U.S.-based sponsor banks. The report found that while embedded finance programs drive significant revenue (over 50%) for sponsor banks, a majority (80%) of respondents reported that meeting embedded finance compliance requirements as a sponsor bank is challenging in the current environment.

Alloy’s State of Embedded Finance Report comes at a time when sponsor banks in the U.S. face drastically increased regulatory scrutiny. According to data from Klaros Group, 25.6% of the FDIC’s formal enforcement actions have been directed at sponsor banks since the beginning of 2024.

“Running a sponsor bank program is inherently complex because you have banks who are highly regulated working with companies that are often new, fast-growing, and creating entirely new ways for consumers to interact with money,” said Tommy Nicholas, CEO and co-founder of Alloy. “Despite the challenge, we’re already seeing sponsor banks respond to regulatory developments by investing in better controls, training, and adding to their compliance tech stack.”

These recent compliance violations have resulted in financial consequences for sponsor banks: Alloy’s report found that 75% of sponsor banks have lost $100k or more due to compliance violations, with 39% reporting losses of $250K or more and 6% reporting losses of $1M or more. However, financial losses are far from the worst consequence of regulatory violations: decision-makers at sponsor banks rank reputational damage as the top consequence of mishandling fintech partners’ compliance.

Alloy’s report found that sponsor banks’ top barriers to maintaining a compliant embedded finance program are 1) a lack of control over their fintech partners’ policy controls and 2) a lack of auditability of their fintech partners’ policy controls. Earlier this year, Alloy launched Alloy for Embedded Finance, a product that gives sponsor banks, electronic money institutions, and program managers in the U.S., U.K., and E.U. the ability to oversee the compliance policies of their fintech partners. Alloy for Embedded Finance directly addresses embedded finance providers’ need to have greater control and visibility into their fintech partners’ compliance programs. Today, Alloy also announced a new module within Alloy for Embedded Finance: Audit Access. Tools like Alloy for Embedded Finance are becoming more widely adopted by sponsor banks: Alloy’s report found that sponsor banks’ most likely course of action in response to regulatory scrutiny is investing in new compliance technology.

“Using Alloy for Embedded Finance has been a game changer for our team,” said Teddy Gordon, Director of Data at Grasshopper Bank. “We can easily set KYC requirements for our fintech partners and then roll those policies out to our entire program all at once. We ensure we’re compliant across the board, and our fintech partners still get to manage their own risk tolerance.”

Alloy’s State of Embedded Finance report was fielded from May 30th to June 5th, 2024 and includes respondents from sponsor banks in the U.S. with at least $2 billion assets under management (AUM). The report was conducted on behalf of Alloy by The Harris Poll, a global consulting and market research firm.

For more insights, read the full report here.

About Alloy

Alloy solves the identity risk problem for companies that offer financial products. Over 600 banks, credit unions, and fintechs turn to Alloy’s end-to-end identity risk management platform to take control of fraud, credit, and compliance risks, and grow with confidence. Founded in 2015, Alloy is powering the delivery of great financial products to more customers around the world. Learn more at alloy.com.

Media contact:

Kylee Sibilia

[email protected]

SOURCE Alloy