Chinese electronics component makers are offering price reductions of up to 5% to Indian companies as part of new sourcing contract negotiations, driven by concerns over the US trade conflict. US President Donald Trump has slapped a whopping 125% tariff on Chinese goods after China announced retaliatory tariffs.

The US-China trade dispute has considerably reduced new orders to Chinese manufacturers, as global supply networks adjust to reciprocal tariffs, with the US imposing the highest rate of 125% on Chinese goods. The decreased American demand for Chinese electronics will also affect component requirements.

The discounts being offered by Chinese companies are a substantial concession in an industry with slim 4-7% profit margins, according to an ET report. This could potentially allow Indian manufacturers to increase their profits by 2-3%, according to television, refrigerator and smartphone producers. Indian companies might transfer some cost benefits to customers to enhance sales.

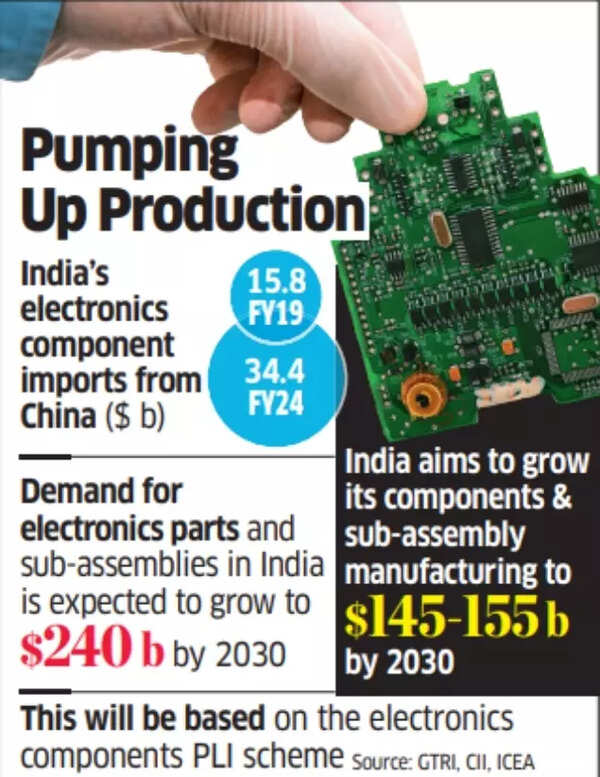

Pumping up production

Chinese imports constitute approximately 75% of all electronics components used in Indian manufacturing.

“Component manufacturers in China are under pressure,” said Kamal Nandi, head of the appliance business at Godrej Enterprises Group. “Prices will be renegotiated as export orders from the US slow down.”

The electronics sector typically maintains raw material stocks for two to three months. Companies will initiate new orders from May-June onwards. According to a recent GTRI report, India’s electronics component imports in FY24 increased by 36.7% to $34.4 billion compared to the previous year. Over five years, imports grew by 118.2% from $15.8 billion in FY19.

Also Read | Apple looks to manufacture more iPhones in India as Trump’s tariffs hit China harder: Report

Chinese manufacturers are experiencing surplus issues, according to Avneet Singh Marwah, chief executive of television contract manufacturer Super Plastronics.

“There is panic. US export shipments from China are on hold. Indian companies and Chinese part makers are negotiating to lower prices by up to 5%,” said Marwah, who has the India licence for Kodak, Thomson and Blaupunkt. “However, since domestic demand in India is not robust, companies may pass some as discounts.” In 2024, electrical and electronic equipment represented the largest segment of US imports from China, amounting to $127.06 billion.

Chinese suppliers are encountering reduced demand in India due to production-linked incentives, quality control orders (QCOs) requiring Bureau of Indian Standards approval for overseas sourcing, and increasing import duties on components, which have promoted local manufacturing. The India Cellular and Electronics Association projects domestic components and sub-assembly manufacturing to reach $145-155 billion by 2030, following the government’s announcement of the Electronics Component Manufacturing Scheme on Tuesday. Currently, India imports essential electronic components including chips, compressors, inner grooved copper tubes, open cell television panels, printed circuit boards, battery cells, display modules, camera modules and flexible printed circuits.

Also Read | ‘I am not Sanjay of Mahabharata’: RBI governor on where repo rate will head amidst Trump’s tariff wars

Dixon Technologies’ managing director Atul Lall indicates that US market slowdown and reduced demand will result in lower component prices. Dixon updates its component inventory every 15-30 days. Counterpoint Research director Tarun Pathak notes that smartphone component prices will decrease due to excess supply, though not all components are interchangeable.

“Brands may partly pass it on or absorb it, depending on inventory position. Almost 75% of the smartphone components used in India are imported from China,” Pathak said.