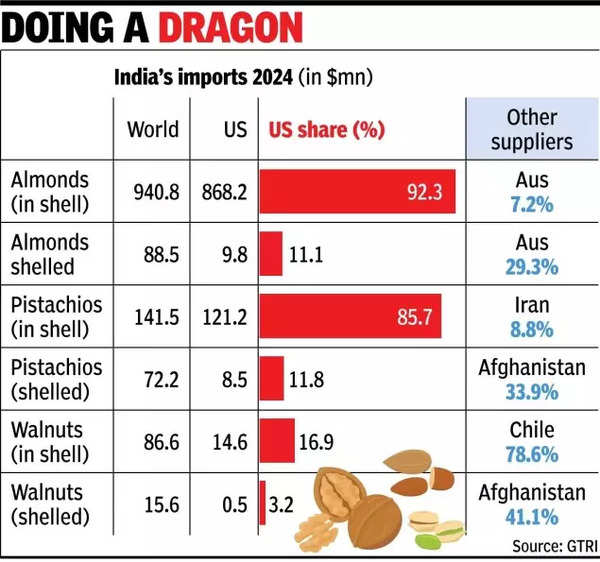

NEW DELHI: When it comes to almonds and pistachios, the US is doing what China has done in the case of electronics, where the dragon dominates the world trade. American almonds account for nearly 93% of India’s import of the commodity, valued at over $1 billion last year, while the share of pistachios was around 84%.

The focus on health and wellness, along with higher income levels, has resulted in more demand for dry fruits. And, production is not sufficient to meet the growing demand, which is resulting in higher imports. For instance, against an estimated production of 4,150 tonnes of almonds during this year (Aug-July 2024-25), imports are estimated at 1.9 lakh tonnes, according to the US department of agriculture.

Since 2008, imports have soared over 5.5 times in case of Almonds. Ditto for pistachios, where imports went up from around 4,400 tonnes in 2008 to around 13,500 tonnes in 2021. “There is greater consciousness to eat healthier food and the boards are doing their bit to promote their products,” said Sumit Saran, India representative of the American Pistachio Growers and Washington Apple Commission.

From aggressive branding to pricing, the American varieties have filled shelves in organised retail segments. Things have reached a stage where the Californian variety pops up more on the e-commerce platforms or even on shop shelves than the homegrown variety. India is now the largest market for the California almond sector.

“American almonds have secured an over 80% market share in India, owing to very strong marketing campaigns sustained over years, that built on health aspirations and traditional food habits of Indian cuisine. Reduction in import duty in India has also resulted in a boost to the overall business of American almonds,” said Mohit Singla, chairman of Trade Promotion Council of India, an industry body with focus on food.

An Indian industry watcher said American almonds are now commanding a premium and no longer come cheap. “Their size is bigger and there is little oil content, yet there are few takers for the Asian variants, despite prices being much lower,” the industry executive said.

A govt official said there is some supply coming from Australia, helped by the recent trade deal, which allows zero-duty imports up to a certain quantity. Chile is also a large player in certain segments but the American suppliers are more organised and have lower logistics costs.

While Iran used to be the top pistachios supplier, poor supply chain has meant that it is competing with those from UAE. Amid US president Donald Trump’s aggressive trade push, American authorities are demanding concessions to ship pecan nuts, while also demanding a “level-playing field” with Australian almonds.