MUMBAI: Health insurance’s share in the non-life segment is set to surpass other categories put together as the sector continues to expand, the chief of standalone health insurer Niva Bupa Health Insurance said.

At present, health is the largest segment with a 40% share of total non-life premium. According to Krishnan Ramachandran, MD & CEO of Niva Bupa Health Insurance, the industry is growing at 14-15%, with significant potential for further expansion and the company’s British parent Bupa is ‘excited’ about the Budget move to allow 100% foreign direct investment.

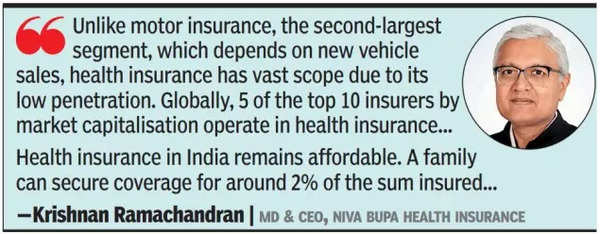

“Unlike motor insurance, the second-largest segment, which depends on new vehicle sales, health insurance has vast scope due to its low penetration. Globally, five of the top 10 insurers by market capitalisation operate in health insurance.”

According to Ramachandran, insurance regulator Irdai’s decision to allow a 10% hike in senior citizen premiums can be implemented while maintaining a combined ratio of 95%. The combined ratio represents the proportion of claims and management expenses to total premiums. The total premium income of the non-life industry was 2,89,673 crore in FY24. “Health insurance in India remains affordable. A family can secure coverage for around 2% of the sum insured, which is reasonable,” he said.

Niva Bupa is leveraging technology to scale operations without increasing fixed costs. “All our policies are digitally onboarded, 51% are issued straight through with automated underwriting, and 21% of retail claims are automatically approved.”

Bupa has a different structure compared to other insurers. As a private company limited by guarantee, it does not distribute dividends but reinvests profits. Niva Bupa is one of Bupa’s two group companies that are listed. Despite the listing, Ramachandran said the company is not under pressure for quarterly profits as its promoter, Bupa, and former promoter and largest shareholder, True North, have a long-term business focus. The 2024 IPO reduced Bupa’s shareholding from 62% to around 55% to create space for foreign investors while staying within the then 74% FDI cap.