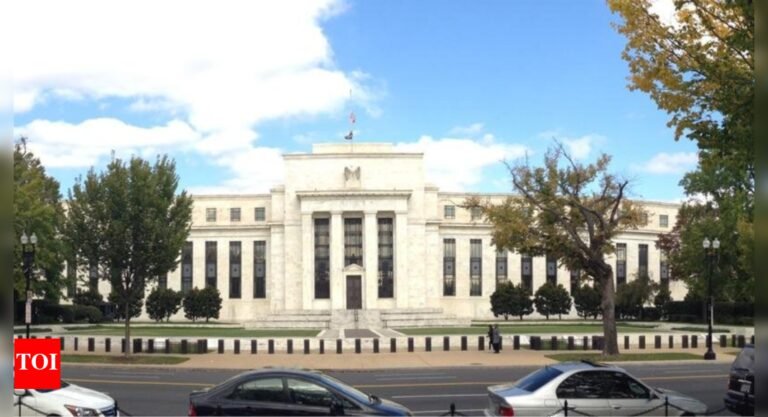

US Federal Reserve Governor Christopher Waller hinted on Monday that interest rate cuts could still be on the table in the coming months, even amid potential inflationary pressures from newly introduced tariffs.Speaking at an event in Seoul, South Korea, Waller said, “I support looking through any tariff effects on near term-inflation when setting the policy rate,” adding that the inflation impact stemming from President Donald Trump‘s recent import taxes is likely to be temporary, reported Reuters.Waller indicated that if tariff levels remain in the low range, and “underlying inflation continues to make progress to our 2% goal” while the labor market remains “solid,” he would support “good news” rate cuts later this year. “Fortunately, the strong labor market and progress on inflation through April gives me additional time to see how trade negotiations play out and the economy evolves,” he said.His remarks come amid growing uncertainty surrounding presidential trade policies, as Trump imposes tariffs with variable rates and implementation timelines. Legal challenges to these tariffs also raise questions about their long-term viability. The federal funds target rate currently stands between 4.25 per cent and 4.5 per cent.Waller acknowledged the complex risk environment, noting, “I see downside risks to economic activity and employment and upside risks to inflation in the second half of 2025, but how these risks evolve is strongly tied to how trade policy evolves.”He also cautioned that higher tariffs could have a negative impact on consumer spending and business operations. “Higher tariffs will reduce spending, and businesses will respond, in part, by reducing production and payrolls,” he said. Waller anticipates a one-time inflation spike, particularly in late 2025, with consumers likely absorbing only part of the effect from modest tariffs.Also read: GTRI recommends this ‘pragmatic route’ for India to deal with Donald Trump’s tariffs on steel & aluminiumAddressing concerns about a repeat of past policy misjudgments, Waller said, “What often has people spooked is we had the same view in 2021, that all this stuff was transitory, it was a one-time level effect, and then it would all go away.” However, he stressed that the current economic environment differs significantly from that of the pandemic era.Turning to financial markets, Waller raised concerns about foreign sentiment toward US government debt. “There’s been a risk-off attitude from foreign buyers of Treasuries, all US assets … It’s not really that big, but it’s definitely there,” he said, adding, “There seems to be an attitude that foreign buyers of assets are not welcome in some sense.”

Trending

- ‘Bullish on Indian market’: European plane maker ATR eyes expansion in India; in talks with airlines

- ITC bets on buyouts to grow food business

- Maharashtra, Karnataka account for 51 pc of FDI in India in FY25: Govt

- Over a dozen companies line up IPOs in 3-6 months

- Auto companies seek govt help for magnet imports

- China tightens supply: India’s auto industry seeks govt help on rare earth magnet imports; key EV parts impacted

- Mohandas Pai flags lack of domestic capital for Indian startups; urges policy overhaul; calls for stronger R&D support

- Trump-Musk rift rattles Wall Street; Tesla share slide exposes market fragility; major indexes take a hit

- Real estate market: Major listed firms sell over Rs 1 lakh crore properties; Godrej leads

- Delhi infrastructure project: Centre approves Rs 24,000-crore plan to decongest Delhi; Tunnel to link Mahipalpur to Vasant Kunj